Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

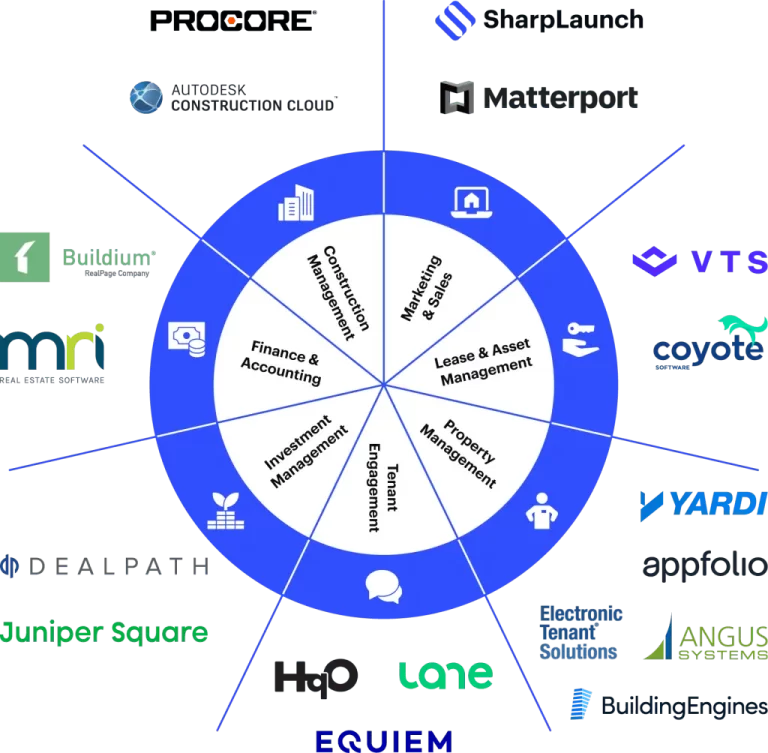

The real estate industry has long been considered a traditional and slow-moving sector. However, recent advancements in technology have significantly transformed the way investors approach real estate investing.

From finding properties to managing investments, technology has introduced tools and platforms that make the process more efficient, transparent, and accessible. Here’s how technology is reshaping real estate investing.

One of the most significant impacts of technology on real estate investing is in the property search and acquisition phase. Online platforms such as Zillow, Redfin, and Realtor.com have made it easier for investors to find properties that meet their criteria. These platforms provide detailed information about properties, including price history, neighborhood statistics, and even virtual tours.

Data analytics has become a crucial tool for real estate investors. Advanced algorithms and big data can analyze market trends, property values, and rental yields, helping investors make informed decisions. Tools like Real Estate Investment Trust (REIT) analytics platforms and investment property calculators allow investors to assess potential returns and risks more accurately.

Virtual and augmented reality (VR and AR) technologies are revolutionizing property viewing. Investors can now take virtual tours of properties without being physically present, saving time and travel costs. AR can also enhance property presentations by overlaying digital information onto physical spaces, helping investors visualize renovations and potential improvements.

Blockchain technology is introducing transparency and security into real estate transactions. This can provide a tamper-proof record of property ownership and transaction history, reducing fraud and disputes. Smart contracts, which execute transactions automatically when predefined conditions are met, streamline the buying and selling process, making it faster and more efficient.

Real estate crowdfunding platforms like Fundrise and RealtyMogul have opened up new opportunities for investors. These platforms allow individuals to invest in real estate projects with relatively small amounts of capital, democratizing access to real estate investments. Investors can diversify their portfolios by investing in multiple properties across different locations.

The use of artificial intelligence (AI) and machine learning (ML) have greatly impacted the real estate investing industry. With AI-powered chatbots, investors can provide immediate customer service, while ML algorithms are able to predict market trends and property values. These technological advancements allow for data-driven decision making, as well as automated processes that increase efficiency and precision.

For those who own rental properties, property management software is a game-changer. Tools like AppFolio, Buildium, and TenantCloud help landlords manage their properties efficiently. These platforms offer features such as tenant screening, rent collection, maintenance requests, and financial reporting, simplifying the day-to-day tasks of property management.

Mobile apps have made real estate investing more accessible and convenient. Investors can now monitor their investments, receive alerts, and manage properties from their smartphones. Apps like Zillow and Redfin offer mobile versions that allow users to search for properties and access market data on the go.

“The best time to buy a home is always five years ago.”

Ray Brown Tweet

Advancements in technology are transforming the world of real estate investing. With the help of data analytics, property searches have become easier and decision-making has become more efficient, transparent, and inclusive. By embracing these innovations, investors can gain a competitive advantage, streamline processes, and make well-informed decisions. This is beneficial for both experienced investors and newcomers, as it simplifies the intricacies of real estate investing and helps achieve financial objectives.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.

Facebook Twitter LinkedIn Reddit Email WhatsApp Getting Started as a Host on Airbnb: A Step-by-Step Guide Are you considering hosting on Airbnb but don’t know

Facebook Twitter LinkedIn Reddit Email WhatsApp Lending and Credit Across Generations: How Financial Practices Have Evolved In today’s fast-paced world, financial habits have transformed significantly

Facebook Twitter LinkedIn Reddit Email WhatsApp Green Loans and Eco-Friendly Lending: A Smart Path to Sustainable Living As awareness of climate change and environmental sustainability