Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

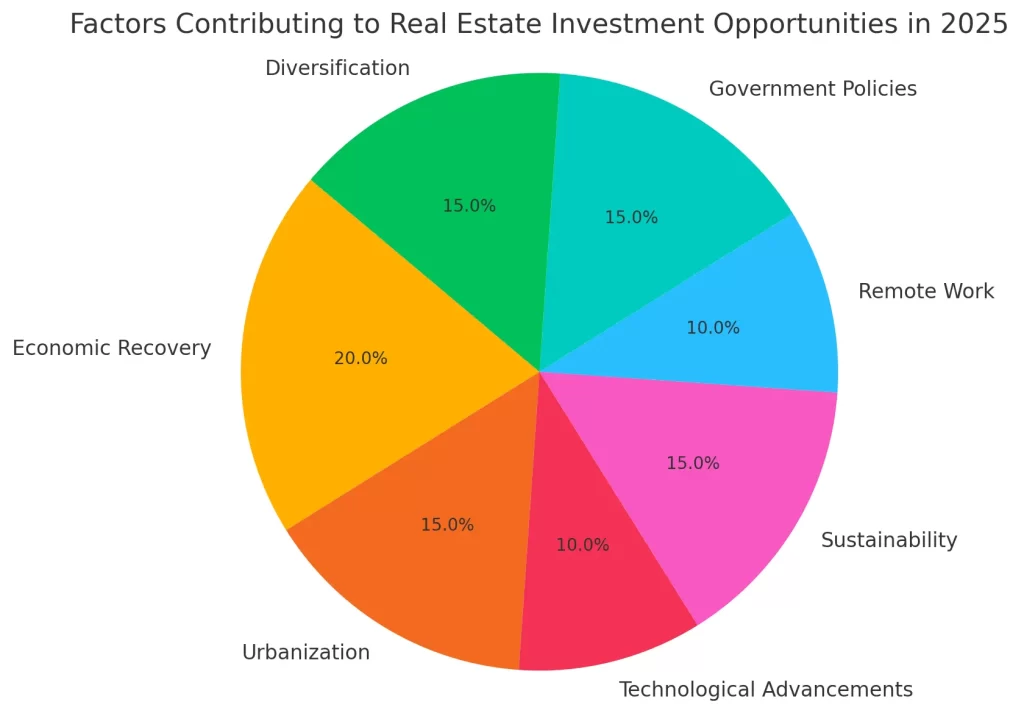

As we approach 2025, the landscape of real estate investment is poised for exciting opportunities and significant growth. The global economy, technological advancements, and shifting demographic trends are all contributing to a dynamic environment that savvy investors can capitalize on. Here’s a comprehensive look at why investing in real estate in 2025 could be a lucrative decision.

The global economy is expected to continue its recovery from the disruptions caused by the COVID-19 pandemic. Governments around the world have implemented policies to stimulate growth, resulting in increased consumer spending and business investments. This economic upswing is likely to boost demand for both residential and commercial properties, making real estate a stable and profitable investment.

Urbanization trends are accelerating, with more people moving to cities in search of better job opportunities and living standards. This migration is driving demand for housing, office spaces, and commercial real estate. Cities with robust infrastructure and amenities are particularly attractive for investors. Furthermore, population growth, especially in emerging markets, is creating a sustained need for real estate development.

The real estate sector is undergoing a technological revolution. Innovations such as smart home technology, virtual reality property tours, and blockchain for transparent transactions are transforming the industry. Investors who leverage these technologies can gain a competitive edge by offering enhanced experiences and streamlined processes to buyers and renters.

Sustainability is becoming a crucial factor in real estate investment. Eco-friendly buildings and green certifications are increasingly in demand as consumers and businesses prioritize environmental responsibility. Investing in sustainable properties not only contributes to a healthier planet but also attracts eco-conscious tenants and buyers, potentially leading to higher returns.

The rise of remote work and flexible office spaces is reshaping the commercial real estate market. Many companies are adopting hybrid work models, reducing the need for traditional office spaces while increasing demand for co-working environments. Investors can capitalize on this trend by investing in adaptable and multi-use properties that cater to the evolving needs of businesses.

Governments are introducing policies and incentives to stimulate real estate development and investment. Tax breaks, subsidies for green building initiatives, and favorable zoning laws are making real estate investment more attractive. Staying informed about these policies can help investors identify profitable opportunities and maximize their returns.

Real estate offers a tangible asset that can diversify an investment portfolio and mitigate risk. Unlike stocks and bonds, real estate provides a physical asset that can appreciate in value over time. Additionally, rental properties generate a steady income stream, providing a buffer against market volatility.

To make informed investment decisions, it’s essential to stay updated on market trends and insights. Analyzing data on property values, rental yields, and occupancy rates can help investors identify emerging hotspots and avoid potential pitfalls. Engaging with real estate professionals, attending industry conferences, and utilizing advanced analytics tools are effective ways to gain valuable market intelligence.

Every person who invests in well-selected real estate in a growing section of a prosperous community adopts the surest and safest method of becoming independent, for real estate is the basis of wealth.

– Theodore Roosevelt Tweet

Investing in real estate in 2025 presents numerous opportunities for growth and profitability. By understanding the economic, technological, and demographic trends shaping the market, investors can make strategic decisions that align with their financial goals. Whether you’re a seasoned investor or just starting, the real estate sector offers a promising avenue for wealth creation in the coming years.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.