Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Investing in real estate can be a lucrative venture, but securing the right loan for your investment property is crucial. Here’s a guide to understanding real estate loans for investment properties, ensuring you make informed decisions and maximize your returns.

There are various loan options available for real estate investors. Here are some of the most common:

Qualifying for an investment property loan is different from getting a loan for a primary residence. Here’s what you need to know:

3. Steps to Secure a Loan for an Investment Property

Follow these steps to secure a loan for your investment property:

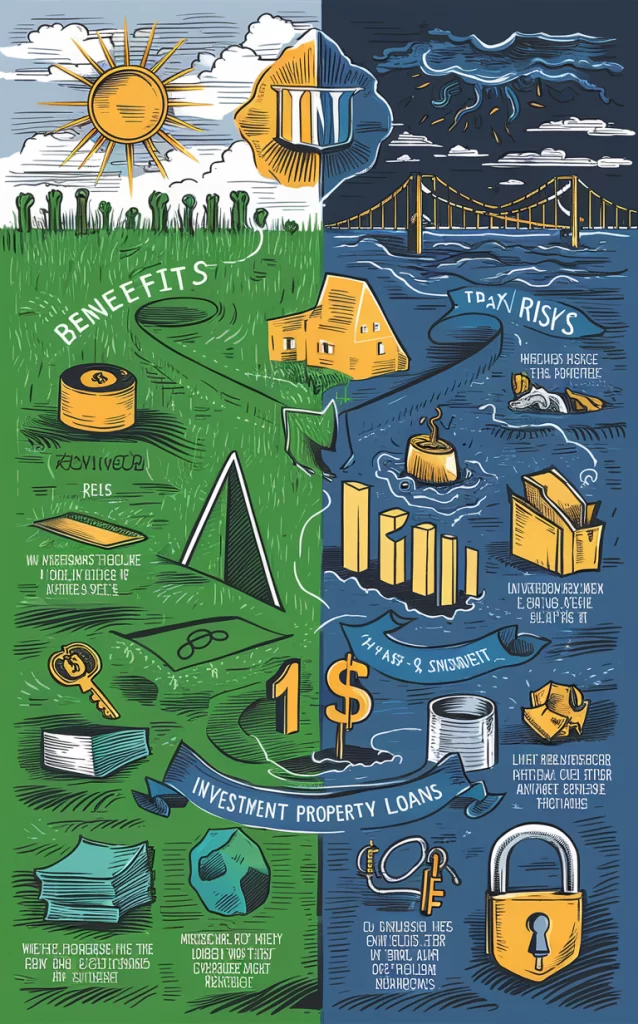

Understanding the benefits and risks can help you make a better decision:

Benefits:

Risks:

Now, one thing I tell everyone is learn about real estate. Repeat after me. Real Estate provides the highest returns, the greatest values, and the least risk.” Armstrong Williams

– Armstrong Williams Tweet

Securing a loan for an investment property requires careful planning and research. By understanding the types of loans available, qualifying criteria, and the steps involved, you can make informed decisions and maximize your investment potential. Happy investing!

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.