Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

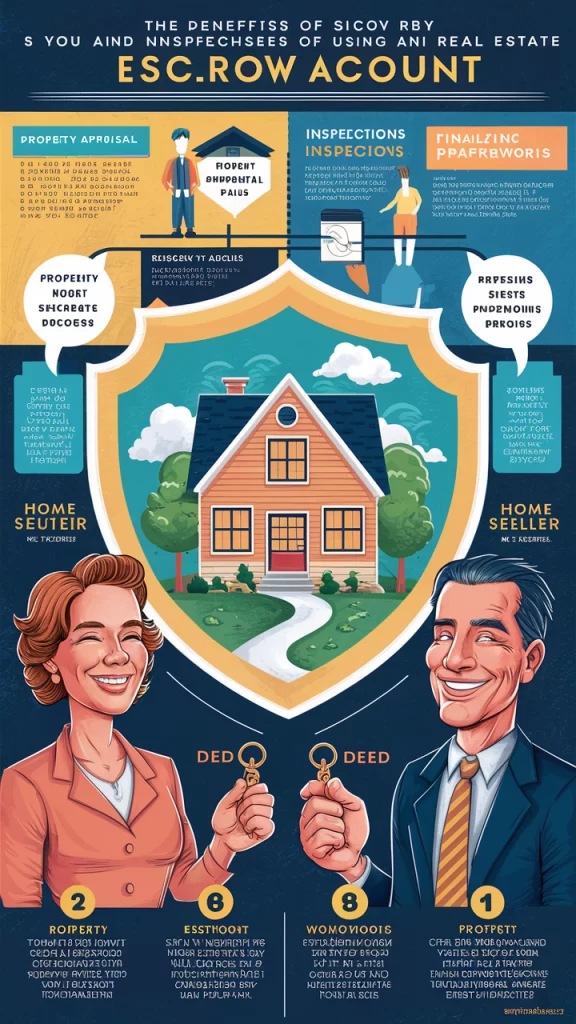

When navigating the world of real estate, you might have encountered the term “escrow account.” Understanding what an escrow account is and how it functions is crucial for both buyers and sellers. In this blog, we’ll dive into the details of escrow accounts, their purpose, and how they work in real estate transactions.

An escrow account is a financial arrangement where a third party holds and regulates the payment of funds required for two parties involved in a given transaction. This account ensures that the transaction is conducted smoothly and securely by keeping the funds safe until all the conditions of the sale are met.

Escrow accounts serve several important purposes in real estate transactions:

Protecting Both Parties: The primary purpose of an escrow account is to protect both the buyer and the seller in a transaction. For the buyer, it ensures that their money is safe and won’t be released to the seller until all the terms of the sale are satisfied. For the seller, it provides assurance that the buyer is financially capable of completing the purchase.

Managing Property Taxes and Insurance: Many lenders require homeowners to have an escrow account to cover property taxes and homeowner’s insurance. The lender collects a portion of these costs with each mortgage payment and holds the funds in the escrow account. When the taxes and insurance premiums are due, the lender pays them on behalf of the homeowner.

3. Facilitating Smooth Transactions: Escrow accounts help facilitate a smooth closing process by ensuring that all conditions of the sale, such as inspections, repairs, and final a greements, are met before the transaction is finalized.

Here’s a step-by-step breakdown of how escrow accounts typically work in real estate transactions:

Opening the Escrow Account: Once the buyer and seller have agreed to the terms of the sale, an escrow account is opened with a neutral third party, such as an escrow company, a title company, or a real estate attorney. The buyer deposits the earnest money into this account as a show of good faith.

Holding Funds: The funds in the escrow account remain there while both parties work to fulfill the contract terms. This may include obtaining financing, completing inspections, and making necessary repairs. The escrow officer ensures that all the agreed-upon terms and conditions are met before moving forward.

Disbursement of Funds: Once all the conditions of the sale have been met and both parties are satisfied, the escrow officer releases the funds to the seller, and the transaction is completed. If for any reason the transaction falls through, the funds are returned to the buyer according to the terms of the contract.

Managing Ongoing Payments: For mortgages, lenders may use escrow accounts to collect monthly payments for property taxes and homeowner’s insurance. These payments are held in the escrow account until the taxes or insurance premiums are due, at which point the lender pays them on behalf of the homeowner.

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes buy a third. And lend your relatives the money to buy a home.

John Paulson Tweet

Escrow accounts play a vital role in real estate transactions by providing security, convenience, and peace of mind for all parties involved. Whether you’re buying or selling a home, understanding how escrow accounts work can help you navigate the process with greater confidence. If you have any questions about escrow accounts or need further assistance with your real estate needs, feel free to reach out to a professional who can guide you through the process.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.