Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

When exploring mortgage options, one term you may come across is a “balloon mortgage.” This type of loan can offer lower monthly payments initially but comes with a large lump-sum payment at the end of the term. Balloon mortgages can be appealing for certain borrowers, but they also come with significant risks.

Is a type of loan that requires the borrower to make relatively small monthly payments for a specified period, typically 5 to 7 years. After this period, a large “balloon” payment of the remaining balance becomes due. Essentially, you pay only interest or a small portion of the principal throughout the loan term, with the bulk of the principal being due in one lump sum at the end.

Here’s a breakdown of how typically operate:

Initial Low Payments: During the initial term of the loan (usually 5 to 7 years), your monthly payments are relatively low. These payments may cover only the interest on the loan or include a small portion of the principal.

The Balloon Payment: Once the initial period ends, the borrower must pay the remaining loan balance in full. This balloon payment is significantly larger than the monthly payments you’ve been making.

Refinancing Options: Many borrowers anticipate refinancing the mortgage or selling the property before the balloon payment is due. However, refinancing depends on the market conditions at that time and the borrower’s financial situation.

Can be beneficial in certain situations. Here are some advantages to consider:

Lower Initial Payments: Since monthly payments are lower at the beginning of the loan, balloon mortgages can be attractive to borrowers who expect their income to increase or who plan to sell the property before the balloon payment is due.

Short-Term Option: If you know you won’t stay in the home long-term, a balloon mortgage may make sense. You can take advantage of lower payments in the short term and avoid dealing with the large payment if you sell the property before the end of the loan period.

Potential for Lower Interest Rates: Balloon mortgages sometimes offer lower interest rates than traditional fixed-rate mortgages, making them appealing to borrowers looking to save on interest costs during the initial loan period.

While balloon mortgages offer some benefits, they also come with significant risks. Here are the key disadvantages to keep in mind:

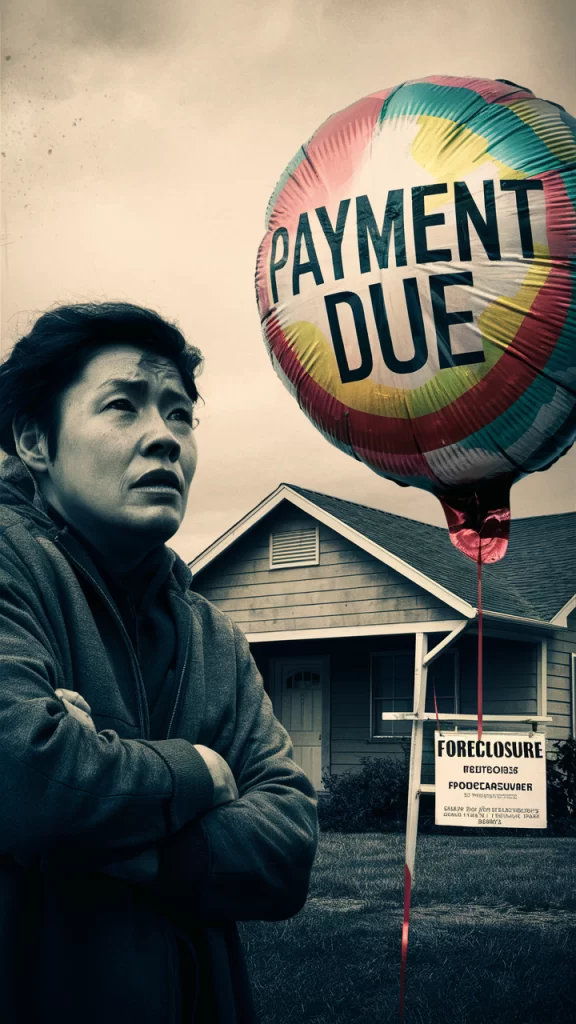

Large Lump-Sum Payment: The biggest risk with a balloon mortgage is the large payment due at the end of the term. If you’re unable to pay off the balance or refinance, you may face foreclosure or be forced to sell the property.

Refinancing Challenges: While many borrowers plan to refinance before the balloon payment is due, there’s no guarantee that refinancing will be available. Changes in interest rates, your financial situation, or the housing market could make refinancing difficult or more expensive.

3. Risk of Losing the Home: If you’re unable to make the balloon payment, you risk losing your home. This makes it riskier than traditional fixed-rate mortgages, where payments are spread evenly over the life of the loan.

Balloon mortgages aren’t for everyone, but they might work well for certain types of borrowers, including:

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes buy a third. And lend your relatives the money to buy a home.

John Paulson Tweet

Balloon mortgages offer an option for borrowers looking for lower initial payments, but they come with the risk of a large final payment. Before choosing this type of loan, it’s essential to carefully consider your future financial plans and whether you’ll be able to handle the balloon payment or refinance the loan when the time comes.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.