Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

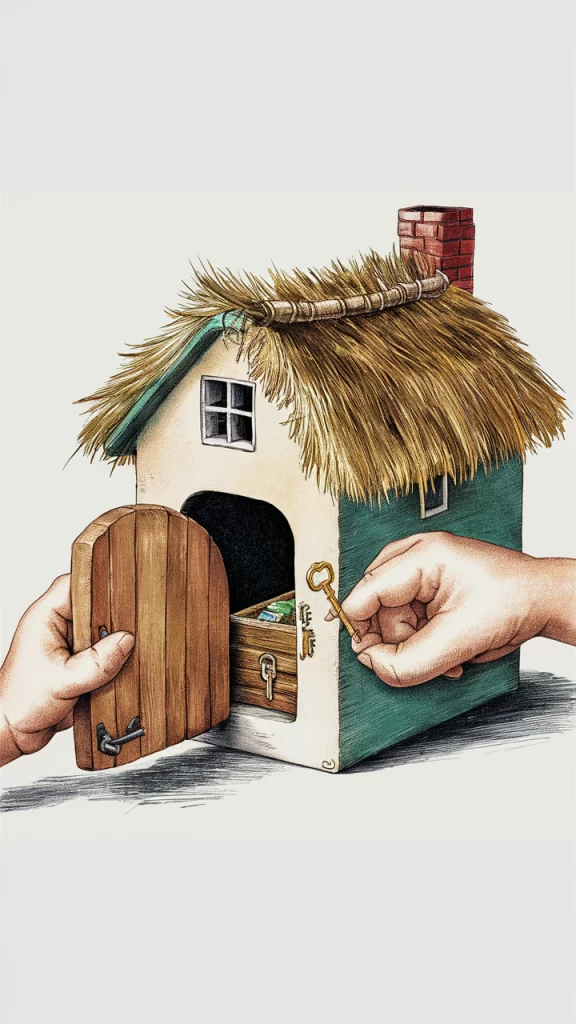

A cash-out refinance is a powerful tool that savvy investors can use to grow their real estate portfolio. By tapping into the equity built up in an existing property, you can secure funds to invest in new opportunities. In this blog, we’ll explore how a cash-out refinance works, its benefits, and how you can use it strategically for property investments.

A cash-out refinance involves replacing your current mortgage with a new one, but for a higher amount than what you currently owe. The difference between the new loan and the existing mortgage balance is given to you as cash. This process allows you to access your property’s equity without selling it.

For example, if your property is worth $400,000 and you owe $250,000 on your mortgage, you could refinance for $300,000. You’d receive the $50,000 difference in cash, which can then be used for other investments.

When used correctly, a cash-out refinance can be a game-changer for real estate investors. Here are some of its key benefits:

Access to Low-Cost Capital

Mortgage rates are typically lower than other forms of borrowing, such as personal loans or credit cards. By refinancing, you access funds at a lower interest rate, which can increase your overall returns on investments.

Opportunity to Scale Your Portfolio

The cash obtained from a refinance can be used as a down payment for new properties, allowing you to expand your real estate holdings. This method is an excellent way to scale your portfolio without relying on personal savings or other sources of capital.

3. Tax Advantages

The interest paid on the refinanced mortgage may be tax-deductible, which could lead to significant savings. However, consulting with a tax professional is recommended to understand how this could apply to your specific situation.

Now that we understand the benefits, let’s dive into how you can effectively leverage a cash-out refinance for your investment strategy.

Evaluate Your Property’s Equity

Before proceeding, assess how much equity you have in your property. Lenders generally allow you to borrow up to 80% of your property’s value. For instance, if your home is valued at $400,000, you could access up to $320,000. Subtract your current mortgage balance from this amount to determine how much cash you could potentially receive.

Check Your Credit and Financial Situation

Lenders look at your credit score, income, and debt-to-income (DTI) ratio when considering a cash-out refinance. Make sure your financials are in good shape, as this will not only help you qualify but also secure a better interest rate.

Research Lenders and Loan Options

Different lenders offer varying rates and terms for cash-out refinances. Shop around and compare options to find the best fit for your financial goals. Remember, even a small difference in interest rates can significantly impact your total repayment over the loan term.

Develop a Clear Investment Plan

Before refinancing, have a clear plan for how you’ll use the funds. Will you invest in rental properties, flip houses, or purchase commercial real estate? A solid strategy helps maximize the return on the cash you withdraw.

Close the Deal and Invest Wisely

Once you’ve secured your cash-out refinance, proceed with your investment plan. It’s crucial to invest in properties or projects that offer good returns, as this ensures that the additional debt taken on through refinancing pays off in the long run.

While cash-out refinancing offers many benefits, it’s essential to be aware of potential risks:

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes buy a third. And lend your relatives the money to buy a home.

John Paulson Tweet

A cash-out refinance is a powerful tool for property investment when used strategically. By unlocking the equity in your existing property, you can access low-cost capital, expand your portfolio, and take advantage of tax benefits. However, it’s crucial to evaluate your financial situation, research your options, and develop a clear investment plan to mitigate risks.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.