Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Navigating financial difficulties can be challenging, especially when it comes to keeping up with mortgage payments. If you find yourself struggling to make ends meet, you may have heard about mortgage forbearance as a potential solution. But what exactly is mortgage forbearance, and how does it work? In this blog, we’ll break down everything you need to know about mortgage forbearance, including its benefits, drawbacks, and how to apply.

Mortgage forbearance is a temporary relief option offered by lenders that allows homeowners to pause or reduce their mortgage payments for a specified period. This option is typically available to borrowers facing financial hardships due to circumstances like job loss, medical emergencies, or natural disasters. It’s important to note that forbearance does not forgive the debt; it merely provides a temporary reprieve. Once the forbearance period ends, the homeowner must resume regular payments and repay the missed or reduced payments.

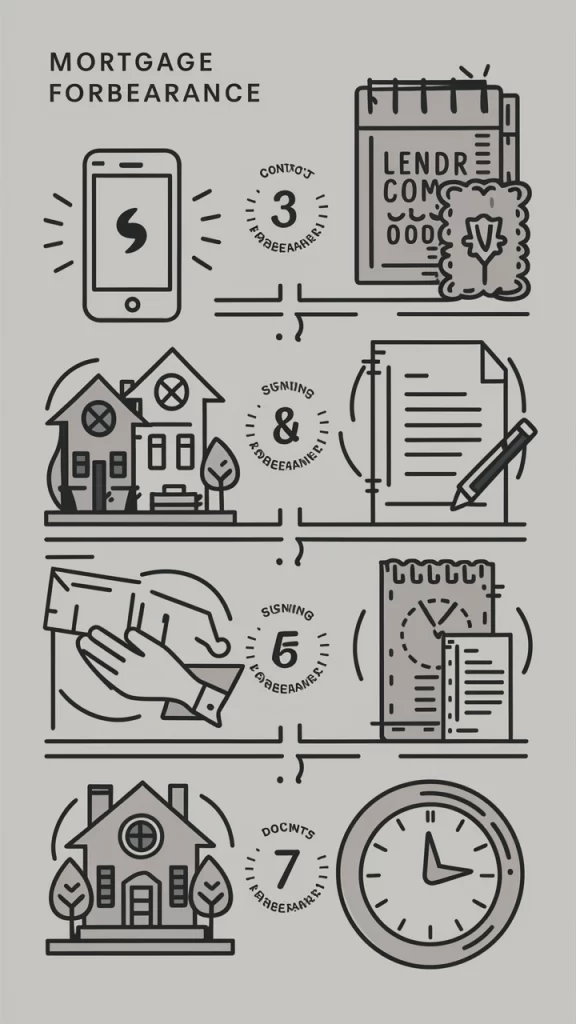

Mortgage forbearance works by allowing homeowners to negotiate a temporary change in their mortgage payment plan with their lender. Here’s a step-by-step breakdown of how the process typically works:

Assess Your Situation: Before reaching out to your lender, take a close look at your financial situation to determine if forbearance is the right option for you. Consider factors such as your current income, savings, and any expected changes in your financial status.

Contact Your Lender: Next, contact your lender or mortgage servicer to discuss your financial difficulties. It’s essential to be honest and transparent about your situation. The lender will assess your case and may request documentation to support your claim, such as proof of income loss or medical expenses.

Review the Forbearance Agreement: If the lender approves your request, they will provide a forbearance agreement outlining the terms, including the length of the forbearance period, the reduction in payments (if applicable), and how the missed payments will be repaid. Make sure to read the agreement carefully and ask any questions you might have.

Forbearance Period: During the forbearance period, your mortgage payments will either be reduced or suspended. This period typically lasts between 3 to 12 months, depending on your lender and your specific situation.

Repayment Plan: After the forbearance period ends, you will need to repay the missed payments. Repayment options vary by lender and may include a lump-sum payment, a repayment plan, or a loan modification that adds the missed payments to the end of your mortgage term.

Mortgage forbearance options can vary depending on your lender and the type of mortgage you have. Common types include:

Short-Term Forbearance: This is usually a 3 to 6-month relief period where mortgage payments are paused or reduced. It’s typically offered to homeowners who expect to recover from their financial hardship relatively quickly.

Long-Term Forbearance: This option extends beyond six months and can last up to a year or more, depending on the circumstances. It is often available to borrowers dealing with prolonged financial difficulties, such as long-term unemployment or recovery from a significant disaster.

While mortgage forbearance can be a lifeline during tough times, it’s crucial to weigh the pros and cons before deciding if it’s the right move for you.

Pros:

Cons:

If you think mortgage forbearance might be right for you, follow these steps to apply:

Review Your Mortgage Documents: Check your mortgage agreement and any communication from your lender to understand your options and any specific criteria that must be met.

Gather Documentation: Prepare any necessary documents, such as proof of income, bank statements, and a letter explaining your financial hardship.

Contact Your Lender: Reach out to your lender’s customer service or hardship department. Be prepared to explain your situation and provide the required documentation.

Understand the Terms: Make sure you fully understand the terms of the forbearance agreement, including the length of the forbearance period, the repayment plan, and any potential fees or interest that may accrue.

“I’m a big believer in a high-quality realtor and I endorse realtors for that reason. High-quality real estate agents all over America.”

Dave Ramsey Tweet

Mortgage forbearance can be a valuable tool for homeowners facing temporary financial hardships, providing a much-needed pause or reduction in payments while you get back on your feet. However, it’s essential to understand that forbearance is not a permanent solution and comes with its own set of responsibilities and potential drawbacks.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.