Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

When it comes to borrowing money, misinformation often clouds the truth. Whether you’re considering a mortgage, a personal loan, or even a credit card, understanding the reality behind common lending myths can help you make smarter financial decisions. Let’s dive into the top lending myths and set the record straight.

Many people believe that only those with an excellent credit score can qualify for loans. While it’s true that a high credit score can lead to better interest rates, it’s not the only path to loan approval.

Reality: Lenders consider a range of factors, including income, employment stability, and debt-to-income ratio. Even with a lower credit score, you might still qualify for a loan, though the interest rates may be higher. Some lenders even specialize in working with individuals with fair or poor credit.

The idea of saving up instead of borrowing sounds logical, but it’s not always the best approach, especially for major purchases like a home or a car.

Reality: While saving is essential, certain purchases or investments may be more practical through financing. For instance, buying a home can help build equity and offers tax benefits that renting may not. Additionally, with manageable loan payments, you can free up cash flow to cover other expenses or investments rather than waiting years to save the full amount.

Another widespread myth is that all lenders offer the same terms, so it doesn’t matter who you choose. However, this couldn’t be further from the truth.

Reality: Different lenders have varying fees, interest rates, and policies. Shopping around for lenders can make a huge difference in what you’ll end up paying over the life of your loan. Some lenders also specialize in certain loan types, like FHA loans for first-time homebuyers, which may offer benefits not found elsewhere.

Paying off a loan early seems like a smart move to save on interest, right? While that’s true for many loans, some come with a catch.

Reality: Certain loans come with prepayment penalties, meaning you might be charged a fee for paying off your loan ahead of schedule. It’s essential to review your loan agreement before making extra payments. If your loan doesn’t have prepayment penalties, then early repayment can indeed save you money on interest.

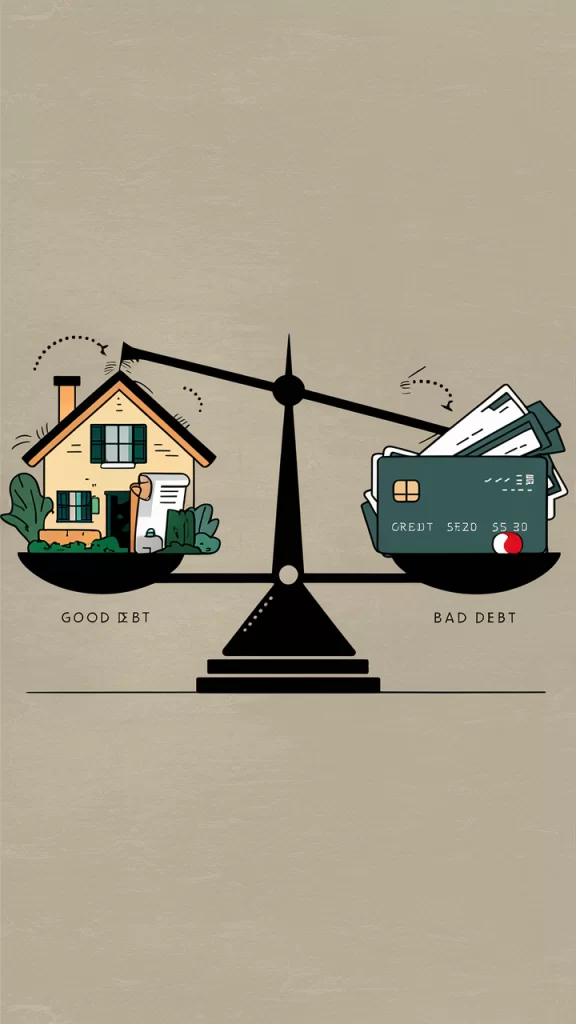

Debt often carries a negative reputation, but not all debt is created equal. Some forms of debt can actually help improve your financial situation.

Reality: There’s a difference between good debt and bad debt. Mortgages and student loans, for example, can be considered good debt because they often provide long-term benefits like building home equity or increasing earning potential. On the other hand, high-interest credit card debt can be harmful if it becomes unmanageable. Understanding when debt works in your favor is key to managing finances responsibly.

Many people worry that applying for a loan will drastically lower their credit score, but this fear is usually exaggerated.

Reality: When you apply for a loan, lenders conduct a “hard inquiry” on your credit, which may lower your score by a few points temporarily. However, the effect is usually minor and fades over time. In fact, responsible borrowing and on-time repayments can help improve your credit score in the long run.

If you’ve been making loan payments for several years, refinancing might seem counterintuitive. However, refinancing can sometimes be a smart financial move.

Reality: Refinancing to a lower interest rate or a different loan term can reduce monthly payments or the overall interest paid, even if you’ve been paying for years. It’s especially worth considering if interest rates have dropped since you first took out the loan.

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes buy a third. And lend your relatives the money to buy a home.

John Paulson Tweet

Understanding the truth behind these common lending myths can help you make better financial choices. Always take the time to research and consult with professionals when considering a loan, and remember, not all debt is harmful. By making informed decisions, you can leverage loans to help reach your financial goals.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.