Airbnb Guest: A Host’s Guide to a Memorable Start

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

When it comes to real estate lending, one crucial component often overlooked by many borrowers is title insurance. This essential insurance policy plays a key role in safeguarding both lenders and buyers from potential issues related to property ownership. Understanding its importance can help you make more informed decisions throughout the real estate transaction process.

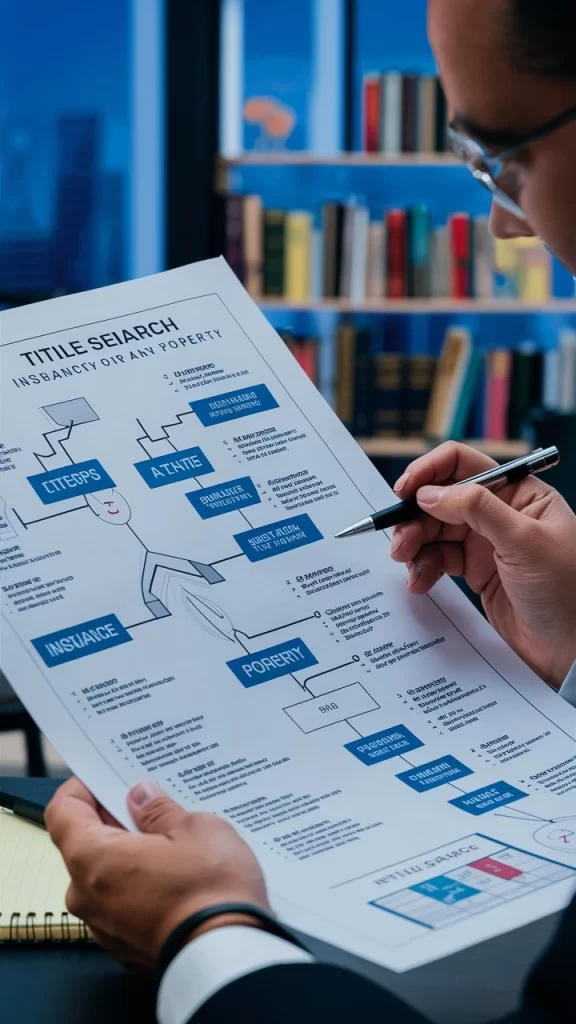

Is a policy that protects lenders and property buyers against any legal claims or disputes over the ownership of a property. Before a property is sold, a title search is conducted to verify that the seller has legal ownership and the right to transfer it. Despite thorough checks, there can still be issues with a property’s title, such as hidden liens, undisclosed heirs, or mistakes in public records. Title insurance steps in to provide financial protection in case these problems arise after the sale.

There are two main types of title insurance:

In real estate lending, the lender needs to ensure that the property used as collateral for the loan has a clear title. This is where title insurance comes into play. Below are some key reasons why title insurance is crucial for lenders:

In some cases, third parties may claim ownership of the property after the transaction is complete. This could stem from unresolved legal disputes, previous owners who were unaware of the sale, or even fraud. Title insurance protects the lender by covering any legal expenses and potential losses.

Liens, such as unpaid taxes or contractor fees, can sometimes remain attached to a property even after a sale. If these issues aren’t uncovered during the title search, the lender could face unexpected financial claims. Title insurance ensures that any pre-existing liens are taken care of and do not affect the property’s value or ownership.

Title insurance provides peace of mind for both lenders and borrowers. With a title insurance policy in place, lenders feel more confident about issuing loans, knowing that their investment is protected. This smooths the loan approval process, making it faster and easier to close on a property.

The process of obtaining title insurance typically begins with a title search, conducted by the title insurance company or an attorney. This search investigates public records to identify any potential issues with the property’s title. If any red flags are found, they are addressed before the property transaction is finalized.

Once the title is deemed clear, the insurance policy is issued. Lenders typically require borrowers to purchase lender’s title insurance as part of the closing costs. It’s a one-time fee, meaning the borrower doesn’t need to worry about ongoing payments. In case a title issue arises after the sale, the insurance company will step in to resolve the problem or compensate the lender for any losses.

While it may seem like the title search is thorough enough to catch every potential issue, some problems may still surface later. Common title issues include:

These issues can be costly and time-consuming to resolve, which is why having title insurance is so valuable for all parties involved.

“The best investment on Earth is earth.”

Louis Glickman Tweet

In the world of real estate lending, title insurance is a crucial layer of protection for lenders and buyers alike. It ensures that the property being financed has a clear title, safeguarding against future legal disputes, liens, or claims that could impact the property’s value or ownership. While it may seem like just another cost during the home-buying process, title insurance provides long-term peace of mind, protecting one of the largest investments most people will ever make.

Facebook Twitter LinkedIn Reddit Email WhatsApp Welcome Your First Guest on Airbnb: A Host’s Guide to a Memorable Start Welcoming your first guest on Airbnb

Facebook Twitter LinkedIn Reddit Email WhatsApp Mastering Airbnb Policies and Legal Requirements: A Guide for Hosts If you’re considering hosting on Airbnb, understanding the platform’s

Facebook Twitter LinkedIn Reddit Email WhatsApp The Anatomy of a Perfect Airbnb Listing Creating an irresistible Airbnb listing is both an art and a science.