At Axelrad Capital, securing a private loan for equipment financing has never been easier! Our streamlined process begins with a simple and straightforward application, designed to save you time and effort. Once submitted, our team of experienced loan experts will thoroughly review your information and carefully match you with the ideal loan program that best aligns with your specific business needs and investment goals. Whether you’re looking to upgrade, replace, or acquire new equipment, we’ll tailor a solution that offers competitive rates, flexible terms, and swift approvals to help you achieve your objectives efficiently.

Equipment Loans

$50,000 to $5,000,000+ available in all 50 states

Keep Your Business Moving Forward

Call (832 850 2267 for our rates!

Equity In The Equipment You Buy

If you’re purchasing equipment that has a long useful life that won’t become outdated in the near future, then an equipment loan may be your best option. At the end of the term, you’ll gain ownership of the equipment and may be eligible for tax savings through depreciation deductions.

What Time of Equipment?

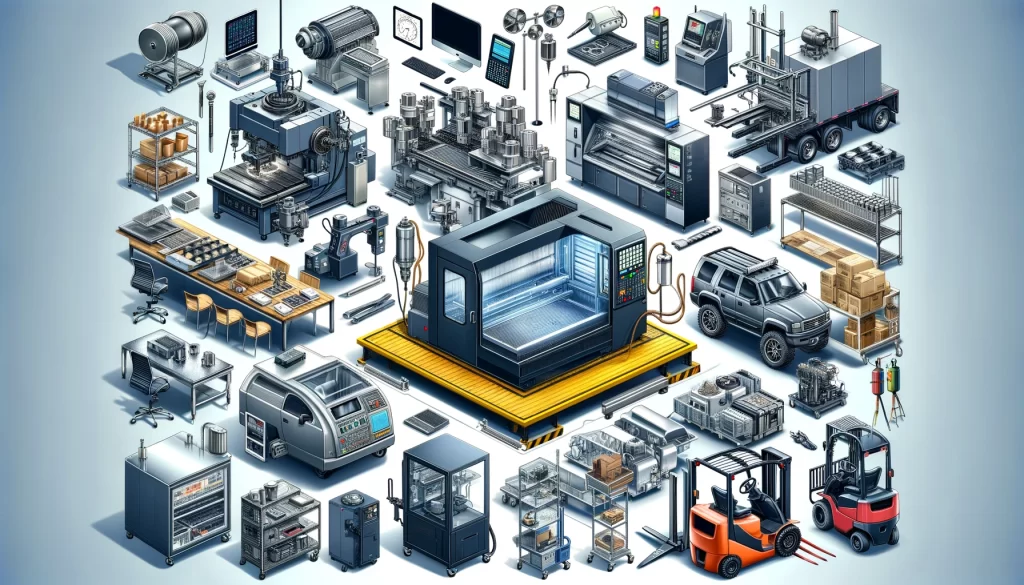

Most items that your business uses to produce, store, sell, or provide services can potentially qualify for SBA financing. Here are some examples of what may qualify:

Manufacturing Equipment: CNC machines, lathes, printing presses, commercial kitchen equipment, welding equipment

Storage & Warehouse Equipment: Forklifts, commercial shelving systems

Automotive Service Equipment: Automotive lifts, spray booths, diagnostic machines

Food Services: Commercial kitchen equipment, coffee roasters, refrigeration equipment

Transportation Equipment: Commercial vehicles, trailers, dispatch equipment

Electronics: Computers, displays, printers, communication devices